Most people who want to insure their life first ask how much is life insurance. Life insurance costs can be a challenge to calculate because there are several kinds of life insurance – including whole life, universal life and term life insurance.

The cost of life insurance is unique to each personal and depends on the “type of policy” you choose, the amount of coverage you want, and the factors such as your overall health and age.

[sc:336×280 ]

Comparing online the life insurance rates can be a good way to get an idea of what you might pay in premiums by knowing how much is life insurance. But to get a customized plan that fully meets your needs and budget, it is a good idea to work directly with an agent.

For detailed answers and a review of your situation, contact an independent agent in the Trusted Choice network who specializes in life insurance. A local member of the agent in your area can help evaluate your options and provide a customized quote.

Factors That Affect Your Life Insurance Costs

- Health profile: Do you have any chronic conditions? Do you smoke?

- Age: Overall, life insurance rates increase as you age.

- Gender: Women live longer, statistically, and typically pay lower life insurance costs.

- Occupation: Receptionist? Machine operator? Sky diving instructor? Yes, it matters.

- Exams: “No exam” life insurance quotes are available, but are typically more expensive.

Insurance FAQs: How to Identify Factors That Affect Life Insurance Premiums

This video from youtube.com: A number of the different factors have the potential to affect “life insurance” in the variety of interesting ways.

To look at some average life insurance rates, we will review several scenarios. Why? Because the average cost of life insurance for a 30 year old male who smokes is very different from the average cost for a 30 year old female with a clean bill of health. To illustrate the range of costs associated with life insurance, the following section will give some hypothetical scenarios for you to think about before you buy a plan.

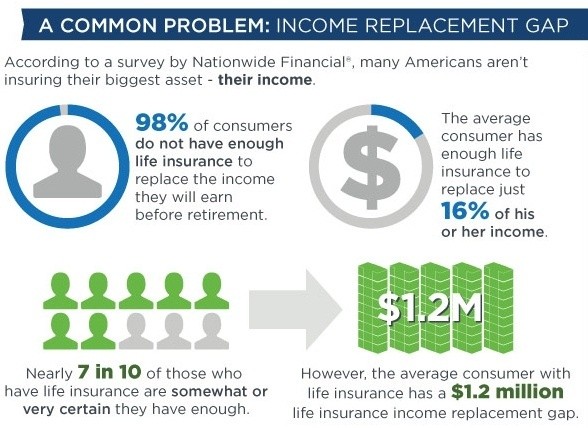

Image @ How Much Life Insurance Is Enough? (inthenation.com)

Life Insurance Cost More in Certain Regions

There can be some differences in your life insurance costs, depending upon your state and region. Life insurance companies use “mortality tables” to help predict the benefits they are likely to pay in a given year. Why? Because the amount they collect in premiums must be less than what they pay out in benefits, and these actuarial tables ensure that they will not end up in a deficit.

Some factors that may be considered to calculate your life insurance costs in your region.

Include:

- Whether there is a high rate of obesity in your state or region

- If the area experiences a high rate of deadly natural disasters, such as earthquakes

- If the region is prone to certain diseases, such as black lung disease typical in miners

- If the state or region has a high mortality rate due to crime

- How many policies have been written in that area

[sc:468×60 ]

How to Lower Your Life Insurance Costs?

Since health and lifestyle play a key role in determining your life insurance rates, the key things you can do to lower your payments have to do with improving your health and reducing your risk of chronic conditions like diabetes or cancer. Being a non-smoker is perhaps the most critical choice you can make to reduce your life insurance rates, but there are many more things you can do as well.

These things are:

- If you have a high BMI, work with a health professional to lose excess weight.

- Maintain your heart health to reduce the risk of hypertension, heart attack and stroke.

- Regularly check your blood pressure, cholesterol, and triglyceride levels.

- Work with a health professional to improve your numbers, if needed.

- Reduce stress, improve your diet and increase exercise.

- Manage your blood sugar to reduce the risk of diabetes.

- Request a blood sugar test.

- Obtain a diet and exercise plan to help manage blood sugar levels.

In conclusion, many people want to know how much is life insurance so that they can insure their life. If you are one of these people, find an independent agent in the Trusted Choice network today to get more information on life insurance rates. An agent right in your area can help you evaluate your life insurance options and costs based on your unique circumstances.

Resource: Life Insurance Rates (trustedchoice.com) – How Much Is Life Insurance?

![Review Hamilton Beach Breakfast Sandwich Maker [25490A Dual] hamilton beach breakfast sandwich maker](https://ruixinxin.com/wp-content/uploads/2014/12/hamilton-beach-breakfast-sandwich-maker-80x60.jpg)